The changing face of financial services

A generation ago, financial services products were primarily sold face to face, either in branches or door to door, with documents manually filled in and posted to their destination. Customer service was dealt with through the same, physical, channels. This has changed radically, with the introduction of first the phone, then the web, and now social media, as sales and support channels.

Managing this multichannel experience is complex, particularly as banks and insurers need to meet strict regulatory requirements and deliver a complete audit trail of activities. Equally, customer expectations are rising as they demand service through their channel of choice.

Speaking at the recent IQPC Customer Experience Exchange for Financial Services event, Oliver Rust of Nielsen showed how the market has changed, based on the company’s Global Survey of Saving and Investment Strategies. For consumers looking to buy investment products branch (60%) and online (59%) are neck and neck as the channels of choice, but customer feedback is that no one lender delivers a consistent experience across every channel.

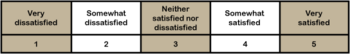

Understanding customers and what they are looking for is a key part of delivering the right, multichannel experience. Nielsen is looking at how financial services companies can go beyond traditional metrics, such as Customer Satisfaction Index (CSAT) and Net Promoter Score (NPS) to look at emotional engagement. While these metrics focus on customer satisfaction they only go so far – feedback is solicited from consumers, rather than necessarily being freely given. This leads to inconsistencies - Nielsen points out that satisfied and unsatisfied consumers have exactly the same referral rates, for example. Additionally, they record the experience after it has been completed, rather than during the process, where there is the possibility of taking action and improving it.

Measuring emotional engagement during the process has traditionally been difficult, particularly on digital channels where interactions are unstructured. However linguistics can help, particularly by detecting the tone (positive, negative, neutral) of customer communications, providing a better measure of emotional engagement than NPS. By analysing what financial services customers are saying in emails, on web chat or via social media, companies can pinpoint how happy/upset they are, along with the context of their situation.

Feedback is unsolicited, so much less likely to be biased by hindsight, and in real-time, so fast responses can be provided. By linking interactions across different channels, banks and insurers can gain a 360 degree view of their customers, enabling them to provide deeper, more personalised responses which increase engagement.

Linguistics also makes it easier to measure sentiment over a specific period. You can see how customer views of a particular product or service have changed over time – particularly useful if it has been recently introduced or if there have been major amendments to improve it.

The greater the emotional engagement that financial services customers feel, the more loyal they are likely to be, and the more open to cross-selling and up-selling opportunities. At a time when customers are demanding more, linguistics can help deliver the closer, multichannel, relationship that the financial services industry is aiming to provide. To find out more about linguistics and how it can help, download our financial services guide here.

Comments