How good are UK insurers at successfully delivering the online customer experience?

Insurance is an industry that has been radically changed by the rise of the internet. The move online has increased competition, particularly with the growth of price comparison sites which have slashed margins and made customer loyalty a thing of the past. But moving to this new, multichannel, customer-centric and low margin world is proving to be a major struggle for many insurers still hampered by legacy systems and paper-intensive, manual processes.

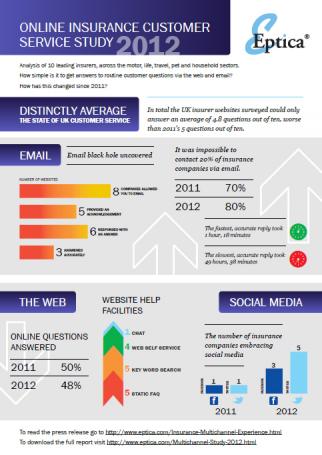

The scale of the problem is highlighted by new research published today as part of the Eptica Multichannel Customer Experience Study. It found that the online customer experience provided by UK insurers has deteriorated over the last year, with less than half (48%) of basic online questions now answered satisfactorily and insurers able to respond successfully to just 30% of emails.

Poor performance continued when it came to email response times. On average it took insurers 30 hours, 6 minutes to answer emails, double the 14 hours of previous research.

The research evaluated 10 insurers active in the motor, life, travel, pet and household sectors. They were tested on their ability to provide answers to 10 routine questions via the web as well as their speed and accuracy when responding to enquiries sent via email, and links to social media.

Overall the study uncovered huge differences in performance:

- One insurer took over 2 days (49 hours) to reply to an email – although another responded in just 1 hour 18 minutes

- The two highest scoring insurers answered 7 out of 10 questions asked on their websites, while the lowest scored just 2 out of 10

- Insurers are still wary of Facebook and Twitter. The study found that social media use has increased dramatically – 50% of insurers now provide links to their Twitter accounts and 30% have Facebook pages (up from 10% on both networks in 2011), although this lags behind other sectors.

You can see the full results in this infographic and read more about the methodology here.

In the era of diminishing margins, increasing market competition and all time low customer loyalty, the insurance industry is at a critical juncture. Delivering an improved customer experience through efficient contact centre and back office service delivery is critical to success.

Based on its experience working with award-winning insurers such as Ageas Insurance Services UK and Domestic & General, Eptica is running a sector-specific webinar where it will discuss the advantages of multichannel customer service to improve efficiency and customer retention. Click here to register for the webinar, which will be held on Tuesday 19th and Thursday 21st February 2013.

Comments